Why should I care?

In the search for new growth opportunities, large and small companies across industries have changed their business models. These companies realize that to be competitive, they must move beyond incremental product innovation into more radical business model innovation.

Most publicized examples of business innovation come from the IT domain:

‘Uber, the largest taxi company in the world, owns no cars’

– is a well-known catchphrase

Such examples provide little guidance to many in the Agri-Food industry. That’s why we’ve explored successful business model innovation strategies in Ag & Food.

Classifying business model innovation

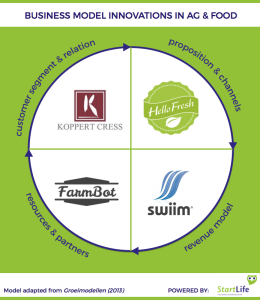

First, we needed a way to classify the main strategies of business model innovation. Luckily, Groeimodellen (2013)[1] provides a great tool: the business model wheel. They identify four primary drivers:

- Customer segment & relation (to whom do we deliver value)

- Proposition & channels (what is the offer and how is it delivered)

- Revenue model (how do we capture value)

- Resources & partners (what and who do we need)

To develop a radically new, successful and competitive business model requires a company to choose one primary driver, while thinking critically about the other, supporting, drivers as well (as indicated by the arrows in figure 1).

Growth opportunities from business model innovation can come from three levels:

- Internal optimization

- Innovating in the supply chain: working with suppliers

- Innovating in the ecosystem, outside your supply chain

So who is doing this?

No more beating around the bush. Let’s look at some real-life examples from Ag & Food. The picture below shows five companies that all focus primarily on one driver for business model innovation.

1 Customer Segment & Relation Innovation

A good example of a food company that applied one of the drivers of business model innovation is micro-vegetable producer Koppert Cress. Their produce has a unique sensory experience and flavors such as lemon and anise. The produce is grown using heirloom herbs seeds from around the world.

Great products. But what about their business model?

Koppert Cress works directly and closely with high-end chefs and hotels that use the micro-vegetables to offer their consumers unique, added value. Through these personal relations with its customers, Koppert Cress is able to gain an in-depth understanding of their market.

Clearly, Koppert Cress does not ignore the other drivers of business model innovation. In fact, the proposition & channels are another key element of Koppert Cress’s success, including a unique small-batch international delivery system.

2 Proposition & Channel Innovation

A well-known example of business model innovation in Ag & Food is HelloFresh. By delivering meal kits directly to people’s home, to simplify fresh cooking, HelloFresh quickly established a new dominant value proposition in the market.

The products and services (meal ingredients, home-delivery) are not radically new per se. However, HelloFresh found new ways to combine existing offerings. Ingredients are proportioned to a specific recipe, maximum variation is offered, and clever content marketing keeps home chefs engaged.

It doesn’t stop there.

Other drivers of business model innovation are applied too. Primarily, HelloFresh relies on a competitive advantage of being a Rocket Internet daughter company. They benefit from elaborate resources and partners. And the revenue model is a clever subscription plan that increases the repeat-purchase rate.

3 Revenue Model Innovation

For Ag & Food companies it can be difficult to transform existing models for capturing value. But one startup is innovating brilliantly on the revenue model. SWIIM System, a water management software platform, helps farmers use water in a more efficient and sustainable way.

SWIIM found no less than three different revenue models to experiment with, as highlighted in an interview with AgFunder:

- a fee-for-service model, charged per acre of land

- a revenue-share model, where SWIIM shares in revenue generated through the water that is conserved

- leasing water management equipment through a subsidiary

What’s behind the revenue-share model is that farmers can monetize their water conservation. They do so by transferring the water lease on the proportion of the farmer’s water allocation that is conserved. This lease can be transferred to other farmers, or the municipality. Nifty right?

What’s truly exciting about this: SWIIM is not just finding ways to make money for itself. It’s also empowering farmers to capture a significant piece of the pie.

In summary, SWIIM innovates on their business model both within the boundaries of its own organization and within the ecosystem.

4 Resources & Partners Innovation

An excellent example of a company that leverages external resources and partners to drive business model innovation is DIY farming startup Farmbot.

This startup develops an open-source, easily accessible precision farming system empowering everyone to grow food.

The hardware, software and data are all open-source, allowing everyone to contribute and further develop and scale Farmbot’s clever automated farming technology. This decentralized approach allows Farmbot to attract valuable resources and partners: the crowd.

As we’ve seen before, the other drivers of business model innovation are not ignored.

In fact, the open-source approach requires Farmbot to develop clever value capture systems, i.e. revenue models. One such model might be selling professional spin-off products to large clients.

Clearly, too, the proposition of high-tech home-growing is innovative, as well as the B2C customer segment and channel. Indeed, Farmbot appears to be innovating radically on all four drivers .

Final notes

The radical business models of these four companies have been unheard of in the challenging Ag & Food industry. The companies are relentless at innovating a particular driver of the business model. What’s more, they used the other drivers to support their primary strategy.

Time will tell, but we can assume these companies will have obtained a lasting competitive advantage.

Now, we hope that aspiring or existing startups have found inspiration from these four business model innovation strategies in Ag & Food. But, although the examples early- and later stage startups, we hope large companies found inspiration too.

Are you a large company in Ag & Food with a business model innovation story to tell? Are there any superb examples we’ve missed? Let us know!

—

Special thanks to Mandour & Brees. Their book ‘Groeimodellen’ was a valuable source. Special thanks also to AgFunder News; who’s coverage on SWIIM made this article possible.

[1] Mandour & Brees (2013). Groeimodellen. Van Duuren Management.